Table of Contents

- Executive Summary: Key Insights for 2025–2030

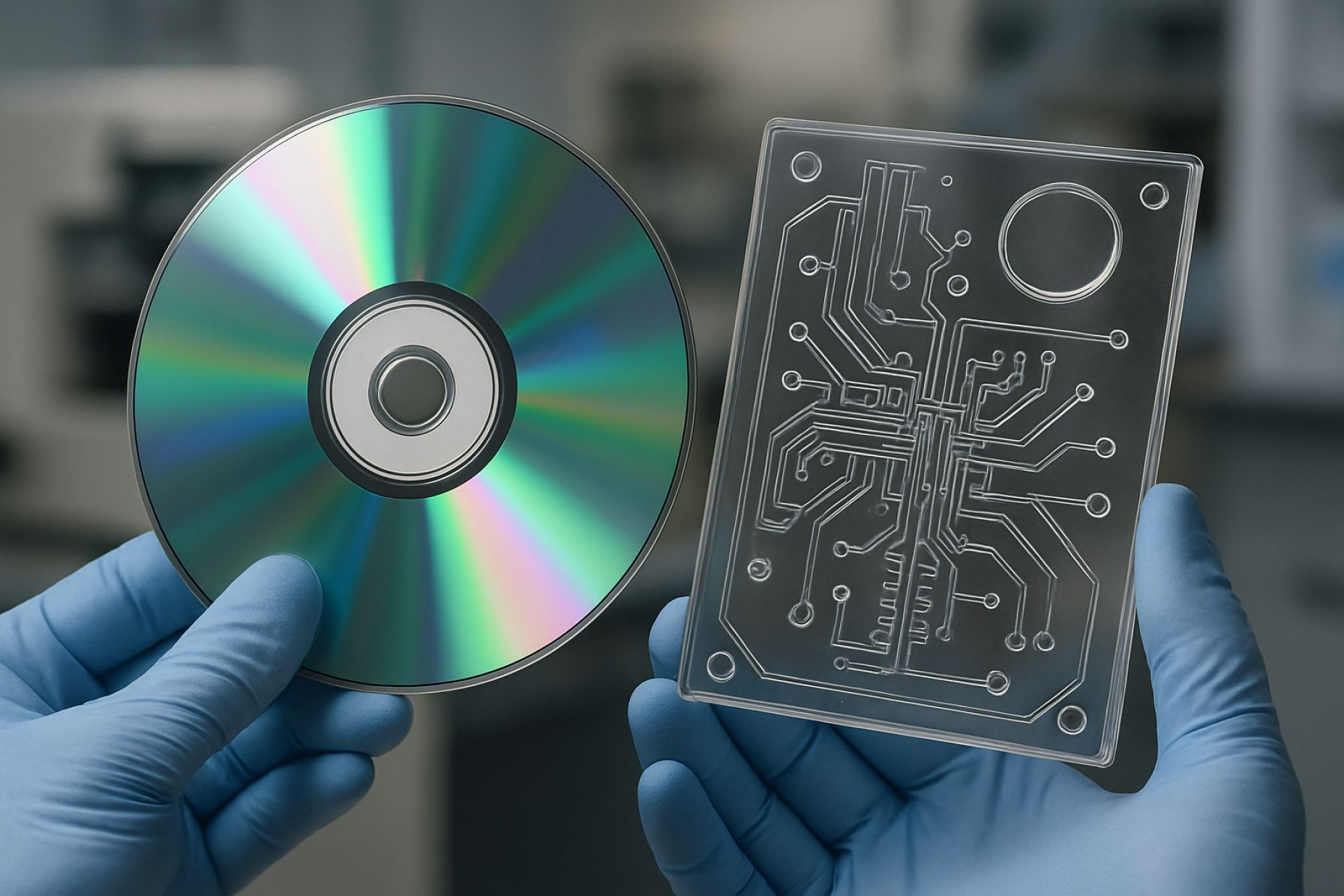

- Technology Primer: Excavated CDx Polymer Microfluidics Explained

- Current Market Landscape and Leading Stakeholders

- Breakthrough Applications in Companion Diagnostics (CDx)

- Materials Innovation: Polymer Advances and Manufacturing Trends

- Regulatory & Standards Roadmap (2025+)

- Competitive Analysis: Global Industry Leaders and Challengers

- Market Forecast: Revenue, Volume, and Regional Trends (2025–2030)

- Emerging Startups and Strategic Partnerships

- Future Outlook: Disruptive Opportunities and Challenges Ahead

- Sources & References

Executive Summary: Key Insights for 2025–2030

Excavated Cdx polymer microfluidics is poised to drive transformative advances in diagnostics, life sciences, and point-of-care testing over 2025–2030. The core innovation—precision micro-scale channels and structures excavated within cyclic olefin-based (Cdx) polymers—offers significant improvements in optical clarity, chemical resistance, and manufacturability over legacy materials like PDMS or glass. Leading industry stakeholders, including Microfluidic ChipShop GmbH and Dolomite Microfluidics, have validated Cdx polymers (notably cyclic olefin copolymer, COC, and cyclic olefin polymer, COP) as the substrate of choice for mass production of next-generation microfluidic cartridges and lab-on-chip devices.

As of 2025, the sector is experiencing rapid scale-up in both prototyping and high-volume manufacturing capabilities. Advanced micro-milling, laser ablation, and injection molding are converging to enable high-throughput excavation of micro- and nano-scale features with sub-micron fidelity. This progress is facilitated by the unique properties of Cdx polymers—low autofluorescence, high transmission in the UV-visible range, and robust physical stability—making them ideal for applications in genomics, molecular diagnostics, and cell analysis. Notably, ZEON Corporation continues to invest in new grades of COC with enhanced biocompatibility and processability, directly addressing emerging needs in the biomedical and pharmaceutical sectors.

The next five years are expected to witness the mainstreaming of excavated Cdx microfluidics in global supply chains. Key drivers include the ongoing miniaturization of diagnostic platforms, integration with digital health systems, and the demand for rapid, decentralized testing environments—trends that have accelerated following the COVID-19 pandemic. Industry initiatives around sustainability and cost reduction are also propelling the adoption of recyclable and lower-carbon-footprint Cdx materials, as highlighted by manufacturers such as TOPAS Advanced Polymers.

Looking ahead to 2030, market analysts anticipate an expanded role for excavated Cdx polymer microfluidics in personalized medicine, environmental monitoring, and resource-limited settings. Strategic collaborations between material innovators, OEMs, and healthcare providers are expected to unlock new device architectures and integrated system solutions. The sector’s outlook remains robust, with continued investment in automation, quality assurance, and regulatory alignment positioning excavated Cdx microfluidics as a technological cornerstone for the next wave of analytical and diagnostic innovation.

Technology Primer: Excavated CDx Polymer Microfluidics Explained

Excavated companion diagnostics (CDx) polymer microfluidics represent a rapidly evolving frontier in precision medicine, integrating tailored diagnostic platforms with advanced micro-scale engineering. At their core, these systems utilize specifically patterned polymer chips with excavated channels and chambers to process minute biological samples—typically blood, serum, or cellular extracts—for the identification of patient-specific biomarkers guiding therapeutic selection.

The excavation process differs from traditional microfluidic fabrication by employing high-precision subtractive techniques, such as laser ablation, micro-milling, or advanced molding, to create three-dimensional networks within biocompatible polymers (most commonly cyclic olefin copolymer (COC), polymethyl methacrylate (PMMA), or polydimethylsiloxane (PDMS)). These designs improve sample flow dynamics, reduce dead volumes, and enable complex multiplexing within compact footprints. In 2025, these characteristics are being leveraged to streamline workflows for oncology, infectious disease, and pharmacogenomic applications, where rapid and accurate CDx results are essential for patient stratification.

Recent deployments by industry leaders underscore the momentum of this technology. For example, Danaher Corporation’s subsidiaries—such as Integrated DNA Technologies and Beckman Coulter Life Sciences—have expanded their microfluidic portfolios to include excavated polymer chips tailored for CDx assays, citing improvements in thermal stability and reproducibility. Similarly, Thermo Fisher Scientific has introduced next-generation consumables integrating excavated architectures, supporting workflows from nucleic acid extraction to digital PCR and next-gen sequencing sample prep, all on the same chip.

In parallel, upstream polymer suppliers such as SABIC and ZEON Corporation have responded with enhanced grades of COC and COP (cyclic olefin polymer) tailored for bioanalytical microfluidics, delivering improved optical clarity, chemical resistance, and surface functionalization options. These advancements support more reliable immobilization of biomolecular probes and facilitate integration with optical and electrochemical detection modules.

Looking ahead to the next few years, the outlook for excavated CDx polymer microfluidics is robust. Increased regulatory clarity around microfluidic-based CDx devices is anticipated to accelerate clinical adoption, while ongoing collaboration between device manufacturers and polymer suppliers is expected to yield further improvements in material performance and manufacturability. As multi-omic and point-of-care CDx platforms become mainstream, the role of excavated polymer microfluidics in enabling decentralized, high-throughput, and cost-effective diagnostics is set to expand significantly, with the potential to transform personalized medicine workflows globally.

Current Market Landscape and Leading Stakeholders

The market for excavated Cdx polymer microfluidics is experiencing dynamic growth as demand for high-throughput, cost-effective, and scalable diagnostic solutions intensifies across clinical, academic, and industrial settings. In 2025, a confluence of technological advancements and strategic investments is shaping the competitive landscape, with several global players and emerging innovators occupying pivotal roles.

Key stakeholders include established polymer microfluidics manufacturers, diagnostics companies, and contract development and manufacturing organizations (CDMOs) specializing in microfluidic device fabrication. Dolomite Microfluidics continues to expand its offerings in polymer-based microfluidic systems, focusing on rapid prototyping and precision manufacturing, which is crucial for the development of excavated Cdx (companion diagnostics) devices. Similarly, Microfluidic ChipShop leverages its expertise in polymer microfabrication to support customized Cdx applications, catering to both early-stage biotech and large diagnostic companies.

Major diagnostics companies, including Roche and Bio-Rad Laboratories, are investing in polymer microfluidics integration for companion diagnostics, aiming for scalable solutions that can be rapidly deployed in clinical settings. These organizations are increasingly partnering with microfluidic technology specialists to streamline the translation from prototype to mass production, addressing the regulatory and quality assurance demands specific to clinical diagnostics.

Materials suppliers play a critical role in this ecosystem. Companies like ZEON Corporation and SABIC provide advanced cyclic olefin copolymers (COCs) and other medical-grade polymers that serve as foundational substrates for excavated microfluidic architectures. Their material innovations are enabling thinner, more chemically resistant, and optically clear devices, which are increasingly required for sensitive Cdx assays.

Looking forward, the next few years are expected to see further integration of automation, digital connectivity, and AI-driven analytics within excavated Cdx polymer microfluidics platforms. Strategic collaborations between diagnostics firms and microfluidics specialists are likely to accelerate, with an emphasis on robust design-for-manufacture and regulatory compliance. Investments in manufacturing scale-up, particularly in Asia and North America, are positioning these regions as key production hubs. Market growth is anticipated to be driven by broader adoption in oncology, infectious disease, and personalized medicine, with ongoing technology refinement to meet evolving clinical and regulatory requirements.

Breakthrough Applications in Companion Diagnostics (CDx)

The landscape of companion diagnostics (CDx) in 2025 is being rapidly transformed by the emergence of excavated polymer microfluidic technologies. These systems, which utilize precisely engineered channels and wells within robust polymer substrates, are enabling a new generation of highly sensitive, multiplexed, and cost-effective diagnostic platforms. The “excavated” approach refers to the direct formation of micro-wells and channels within thermoplastics or other polymers, typically via injection molding, hot embossing, or advanced laser ablation, offering significant advantages in scalability and robustness for clinical use.

Major device manufacturers have accelerated the integration of microfluidics into CDx workflows, particularly for oncology, infectious diseases, and pharmacogenomics. Notably, Thermo Fisher Scientific and Agilent Technologies continue to expand their portfolios with CDx solutions incorporating microfluidic cartridges, allowing for rapid nucleic acid extraction, amplification, and analysis directly from patient samples. These platforms are built on high-precision polymer microfluidic chips, which are increasingly fabricated using excavated manufacturing methods to achieve consistent, reproducible results at scale.

The push towards point-of-care (POC) companion diagnostics is another major trend, with companies such as Abbott Laboratories and Roche investing heavily in compact, cartridge-based systems that leverage excavated polymer microfluidics. For example, these platforms are being deployed in oncology to rapidly determine tumor mutation status or in infectious disease to identify resistance markers, directly influencing treatment decisions within hours rather than days. The reliability and manufacturability of excavated channels in polymers are key for regulatory approval and clinical adoption, supporting the stringent requirements for CDx devices.

In 2025, the demand for customizable, multiplexed CDx assays continues to rise, driven by the growth of personalized medicine. Polymer microfluidic chips with excavated wells and networks are uniquely suited for integrating multiple assays onto a single device, enabling simultaneous detection of multiple biomarkers from a single sample. Companies like Bio-Rad Laboratories are advancing droplet-based microfluidic CDx platforms, utilizing excavated polymer chips for highly parallelized digital PCR and next-generation sequencing library preparation.

Looking ahead, the next few years are expected to witness broader regulatory acceptance of excavated polymer microfluidic CDx devices, fueled by improved reproducibility, lower production costs, and the ability to scale manufacturing to meet global demand. As automation and polymer engineering progress, the precision and complexity of excavated microfluidic architectures will further expand, paving the way for even more sophisticated, decentralized CDx solutions in clinical settings.

Materials Innovation: Polymer Advances and Manufacturing Trends

The evolution of microfluidic device fabrication has been notably accelerated by advances in polymer science, with excavated Cdx (cyclodextrin-based) polymers emerging as a promising material for next-generation lab-on-chip systems. The “excavated” architecture refers to micro- and nanoscale channels sculpted with high precision into a polymer substrate, which, when coupled with the unique properties of cyclodextrins—such as molecular recognition and host-guest chemistry—offer enhanced selectivity and functionality for biochemical analyses and diagnostics.

As of 2025, several industry leaders are refining the integration of excavated Cdx polymers in microfluidic manufacturing. Companies specializing in polymer microfabrication, such as Dolomite Microfluidics and ZEON Corporation, have reported ongoing R&D on cyclodextrin-incorporated polymer substrates to address the increasing demand for rapid, low-cost prototyping and small-batch production. Their efforts focus on optimizing polymer blends for both mechanical stability and chemical compatibility, ensuring longevity and reproducibility of microfluidic devices under operational stresses.

A key trend in 2025 is the shift towards scalable manufacturing techniques compatible with excavated Cdx polymers, such as hot embossing and injection molding. These methods enable the mass production of intricate microchannel networks with sub-micron accuracy, a requirement for reliable analytical performance. Microfluidic ChipShop has demonstrated pilot-scale manufacturing runs of cyclodextrin-functionalized chips with consistent batch-to-batch fidelity, supporting the transition from laboratory prototypes to commercial diagnostics platforms.

Material innovation is also propelled by collaborations with raw material suppliers, including BASF and Dow, which are developing specialized polymer resins with tunable Cdx content and improved optical clarity—critical for fluorescence-based detection in microfluidic assays. These new grades of polymers are engineered to minimize autofluorescence and maximize the loading of functional cyclodextrin moieties, broadening the range of target analytes and enhancing device sensitivity.

Looking ahead, the outlook for excavated Cdx polymer microfluidics is strongly positive. With continued investment in material science and process automation, the next few years are expected to witness widespread adoption of cyclodextrin-based microfluidic platforms in fields ranging from point-of-care diagnostics to environmental monitoring. Industry roadmaps indicate that by 2027, further integration with digital manufacturing and in-line quality control will drive down costs, while the versatility of Cdx polymers will enable increasingly complex assays within compact, single-use devices.

Regulatory & Standards Roadmap (2025+)

As excavated Cdx polymer microfluidics continue to mature in the diagnostics and life sciences sectors, regulatory and standards frameworks are rapidly adapting to keep pace with these innovations. In 2025 and the forthcoming years, the regulatory environment is characterized by a push toward harmonization, increased transparency, and enhanced guidance specific to microfluidic-based diagnostic devices.

A critical driver is the increasing interest from regulatory authorities in the safety, efficacy, and manufacturing quality of microfluidic in vitro diagnostics (IVDs). Regulatory bodies such as the U.S. Food and Drug Administration (FDA) and the European Medicines Agency (EMA) are progressively updating and clarifying guidelines to address the unique aspects of polymer-based microfluidics, including material biocompatibility, device reproducibility, and performance validation.

In 2025, the FDA’s Center for Devices and Radiological Health (CDRH) is expected to expand its guidance regarding polymer microfluidic diagnostic devices, particularly those employing novel fabrication methods such as excavation or subtractive manufacturing. This includes more robust frameworks for premarket submissions (510(k), De Novo, PMA) that specifically address polymer selection, channel fidelity, and long-term stability of excavated structures. The FDA’s ongoing engagement with device manufacturers and standards bodies underscores the commitment to facilitating timely market access while ensuring patient safety.

Parallel to U.S. initiatives, the European Union is finalizing the implementation of the In Vitro Diagnostic Regulation (IVDR), which redefines the conformity assessment pathways for advanced diagnostics. This regulation, now in full effect, places new emphasis on clinical performance, traceability of polymers, and post-market surveillance. Notably, microfluidic Cdx devices fabricated with excavated polymers must now demonstrate compliance with both device-level standards and material-level requirements, such as those articulated by the International Organization for Standardization (ISO), particularly ISO 13485 and ISO 10993 for medical device quality management and biocompatibility, respectively.

In the next few years, industry consortia and organizations such as the SEMI and BSI Group are expected to play a pivotal role in developing consensus standards and validation protocols tailored for excavated polymer microfluidics. These efforts are essential for streamlining regulatory submissions and fostering interoperability across global supply chains.

The outlook for 2025 and beyond is shaped by increasingly collaborative interactions between regulators, manufacturers, and standards bodies. As regulatory clarity improves and harmonized standards emerge, the pathway for commercializing excavated Cdx polymer microfluidic devices will become more predictable, supporting continued innovation and wider adoption in clinical diagnostics.

Competitive Analysis: Global Industry Leaders and Challengers

The global market for excavated Cdx polymer microfluidics is evolving rapidly in 2025, driven by advancements in material science, fabrication technologies, and expanding application domains such as diagnostics, drug delivery, and analytical devices. The competitive landscape is shaped by established industry leaders with extensive manufacturing capabilities and innovative challengers leveraging niche expertise or novel integration strategies.

Among industry leaders, Dolomite Microfluidics stands out for its broad portfolio of polymer microfluidic devices, including those manufactured via precision excavation and micromachining of Cdx polymers. The company continues to invest in scaling up automated production and integrating design flexibility, catering to biomedical and pharmaceutical sectors seeking robust, scalable solutions. Microfluidic ChipShop is another major player, known for its expertise in thermoplastic microfluidics and rapid prototyping services. Their focus remains on high-throughput, cost-effective manufacturing of excavated channel devices for both research and commercial applications.

In North America, Fluidigm Corporation maintains a strong foothold, particularly in the life sciences sector. Their polymer chip technologies, including excavated Cdx variants, are widely adopted in single-cell analysis and genomics workflows. The company’s continued collaboration with academic and clinical partners accelerates application-specific optimization of microfluidic platforms. Similarly, AIM Biotech leverages proprietary hydrogel-integrated Cdx microfluidics for advanced tissue modeling, positioning itself as a challenger with disruptive potential in organ-on-chip and personalized medicine domains.

Asian manufacturers such as uFluidix are gaining traction by offering custom, scalable fabrication of excavated Cdx microfluidic chips, emphasizing rapid turnaround and competitive pricing. Their ability to support both prototyping and mass production makes them increasingly attractive to global OEMs and research institutes.

Looking ahead, the competitive dynamics are expected to intensify as material suppliers, device integrators, and end-user industries demand greater functional integration and miniaturization. The introduction of automation in Cdx polymer excavation processes and advances in multi-material bonding are likely to lower costs and improve device performance. Leaders are prioritizing sustainable manufacturing practices and regulatory compliance to differentiate their offerings in sensitive sectors like diagnostics and therapeutics.

Overall, while established players hold significant market share through robust production infrastructure and established client relationships, nimble challengers focusing on customization, application-driven collaboration, and next-generation device architectures are poised to capture emergent opportunities in the global excavated Cdx polymer microfluidics market in the coming years.

Market Forecast: Revenue, Volume, and Regional Trends (2025–2030)

The market for excavated Cdx polymer microfluidics is poised for significant expansion between 2025 and 2030, propelled by accelerating adoption in biomedical diagnostics, point-of-care testing, and research applications. Revenue is projected to experience a compound annual growth rate (CAGR) in the high single to low double digits, underpinned by increasing demand for high-throughput, cost-efficient, and scalable microfluidic platforms. This growth is largely attributed to the unique advantages offered by Cdx polymers, which enable precise microchannel excavation, high chemical resistance, and compatibility with mass manufacturing techniques such as injection molding and hot embossing.

Volume-wise, unit shipments of Cdx polymer microfluidic devices are expected to double within this forecast period, as OEMs and research institutions transition from traditional glass and PDMS systems to advanced Cdx-based solutions. The shift is particularly notable in segments where biocompatibility, optical clarity, and solvent resistance are essential. With several major suppliers ramping up production capacity, global output is anticipated to reach tens of millions of units annually by 2030, with a concentration in disposable diagnostic cartridges and consumables.

Regionally, North America and Europe are projected to remain the largest markets, driven by robust funding for life sciences, established healthcare infrastructure, and early adoption by leading diagnostics manufacturers. Companies such as Danaher Corporation and Thermo Fisher Scientific are expected to expand their Cdx microfluidics portfolios, leveraging their distribution networks and R&D capabilities. Asia-Pacific, led by China, Japan, and South Korea, is forecast to post the fastest growth rates due to increased investment in biotechnology, government initiatives supporting domestic microfluidics manufacturing, and a burgeoning base of contract manufacturers such as Microfluidic ChipShop.

Key trends influencing the market outlook include the integration of Cdx polymer microfluidics into multiplexed and digital assays, miniaturized sequencing platforms, and wearable diagnostic devices. The growing emphasis on sustainability and recyclability is also driving innovation in Cdx polymer formulations and end-of-life management strategies. Strategic collaborations between material suppliers, device fabricators, and end-users are expected to accelerate product development cycles and reduce time-to-market for new applications.

Overall, the excavated Cdx polymer microfluidics sector is on track for robust expansion, with revenue and volume gains underpinned by material performance advantages, regional manufacturing investments, and rapid diversification of application areas. Stakeholders are likely to see increased competition and consolidation as the market matures toward the end of the decade.

Emerging Startups and Strategic Partnerships

The landscape of excavated Cdx polymer microfluidics is rapidly evolving as emerging startups and strategic collaborations shape the sector’s near-term trajectory. As of 2025, several specialized startups have entered the market, targeting the unique performance needs of cell diagnostics (Cdx) through advanced polymer microfluidics—particularly utilizing excavated (micro-chambered or 3D-structured) device architectures. These devices promise high-throughput, cost-effective, and scalable solutions for single-cell analysis and point-of-care diagnostics.

Startups such as Dolomite Microfluidics have pioneered the commercialization of advanced polymer microfluidic platforms with customizable excavated geometries, enabling rapid prototyping for Cdx applications. Their collaborations with academic institutions and bioinstrumentation companies facilitate integration of robust polymer devices into clinical workflows. Similarly, Fluidigm Corporation continues to expand its microfluidics portfolio, focusing on flexible polymer chips designed for high-resolution cell sorting and molecular diagnostics. Fluidigm’s partnerships with biotechnology firms and research hospitals underscore a growing industry-academia synergy.

In the Asia-Pacific region, companies such as MicruX Technologies have begun to address regional demand for affordable, high-precision excavated polymer microfluidic devices, forging partnerships with local diagnostic startups and reagent suppliers. Another notable player, Zybio Inc., is leveraging its manufacturing scale and R&D capacity to co-develop microfluidic products optimized for cell diagnostics, focusing on integration with automated analyzers.

- Strategic alliances between polymer material suppliers and device manufacturers are also reshaping the ecosystem. Zeon Corporation, a major producer of cyclo olefin polymers (COP/COC), is working closely with microfluidic fabrication startups to ensure material compatibility and supply chain resilience for next-generation excavated Cdx chips.

- The adoption of rapid injection molding and 3D microstructuring technologies is being accelerated by partnerships between startups and established microfabrication companies, such as Rossellotech, which brings expertise in high-precision polymer engineering to the collaboration table.

Looking ahead to the next few years, the sector is expected to see intensified collaboration, with startups serving as innovation engines and larger corporates providing manufacturing scale and regulatory pathways. These partnerships are likely to yield highly integrated, plug-and-play excavated Cdx polymer microfluidic platforms, accelerating their adoption in clinical, research, and decentralized diagnostic environments.

Future Outlook: Disruptive Opportunities and Challenges Ahead

Excavated Cdx polymer microfluidics stand at a pivotal juncture in 2025, promising significant disruption to diagnostics, life sciences, and advanced material engineering. The defining characteristic of these platforms—their ability to deliver high-throughput, finely resolved microchannel architectures in cyclic olefin-based (Cdx) polymers—positions them as versatile solutions for both research and commercial applications.

In the immediate future, several factors are converging to drive adoption. First, the increasing demand for point-of-care (POC) diagnostics is accelerating the need for scalable, low-cost microfluidic devices. The biocompatibility, optical clarity, and chemical resistance of Cdx polymers provide a competitive edge over traditional materials such as PDMS or glass. In 2025, manufacturers like Microfluidic ChipShop and Dolomite Microfluidics are actively expanding their portfolios to include excavated Cdx platforms, facilitating rapid prototyping and mass production for clinical and industrial partners.

A disruptive opportunity lies in the integration of microfluidics with next-generation biosensing and sequencing technologies. The high fidelity of excavated channels in Cdx supports precise fluid handling required for digital PCR, single-cell analysis, and organ-on-chip systems. Notably, companies such as Zeon Corporation are investing in advanced COC (cyclic olefin copolymer) manufacturing to push the boundaries of device miniaturization and automation, anticipating broader adoption in both centralized labs and decentralized healthcare environments.

However, several challenges must be addressed for widespread implementation. Manufacturing consistency and cost-efficient mass production remain hurdles, especially as device complexity increases. Despite advances in hot embossing, injection molding, and laser ablation, scaling up while maintaining micrometer precision is non-trivial. Industry leaders, including Zemax, are collaborating on simulation and process optimization tools to streamline the transition from prototyping to volume manufacturing.

Regulatory compliance and supply chain robustness are also critical. As Cdx-based devices move closer to clinical deployment, ensuring adherence to ISO 13485 and related standards will be mandatory to gain regulatory clearance in key markets. In parallel, initiatives supported by organizations such as Biocom California are fostering collaboration between manufacturers, technology developers, and end-users to accelerate validation and adoption.

Looking ahead, the next few years will likely see excavated Cdx polymer microfluidics evolve from niche research tools to mainstream solutions, driven by advances in fabrication, integration with digital health, and collaborative innovation across the value chain. The sector’s outlook remains robust, underpinned by strong clinical demand and continued industry investment.

Sources & References

- Microfluidic ChipShop GmbH

- Dolomite Microfluidics

- ZEON Corporation

- TOPAS Advanced Polymers

- Thermo Fisher Scientific

- ZEON Corporation

- Roche

- BASF

- European Medicines Agency

- International Organization for Standardization

- BSI Group

- AIM Biotech

- Zemax

- Biocom California